close

- HOME

-

Client & Fees

- Summary

- Tax Returns for Individuals

- Tax Returns for Employed Professionals

- Tax returns for Landlords (non-MTD)

- Tax returns for MTD Landlords

- Accounting & Tax Returns for Sole-Traders (non-MTD)

- Accounting & Tax Returns for MTD Sole-Traders

- Accounting & Tax Returns for Partnerships

- Accounting & Tax Returns for PSCs (IR35)

- Accounting & Tax Returns for SME Companies

-

Services

- Summary

- ID Verification Services

- Personal Self Assessment Tax Planning and Returns

- Book-keeping, Accounting Systems, and Annual Reporting

- VAT Reporting

- CIS Reporting

- Payroll bureau

- MTD for Sole-traders and Landlords

- Training

- Disaster Contingency and Recovery Planning

- Support for new Business Start-ups

- Business growth and development

- MTD

- Training

- Software

- Tax Card

- Contact Us

-

Key InfoCertain Sole-traders and landlords with qualifying income in excess of £50,000 in 2024-25 should have been informed by the HMRC that they must begin MTD reporting from 6 April 2026. The HMRC require taxpayers to file their returns only by their approved software, and there are many good reasons for taxpayers to adopt such solutions. It does not mean, however, that taxpayers must buy and learn new software. Read why.The filing deadline for 2024-25 Self Assessment tax return by 31 January 2026. Please use our guide to help you collect the information needed to complete your tax return: [PDF] [Excel].From 18 November 2025 all company directors and

persons with significant control (PSCs) registered with Companies House must formally verify their identity. Read our Guide. -

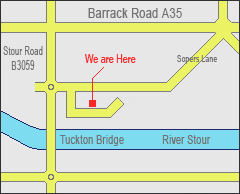

- T: 01202 474545